ABOUT

We offer consumer credit cards, that allow the retailer provide it own credit line to the customer without any bank or financial institution participation, based on it own brand or using MasterCard/ VISA products. The card issuing is accompanied by your store manager profile and your customer/ cardholder web-based profile. It can be crossed with other our products, like bonus cards, gift cards etc. using one card.

PRODUCT HISTORY

The strongest crisis in the United States known to the whole world in the first half of the 1900s gave rise to a new scheme for the sale of goods and services to the population who needed them, but could not pay on their own or by taking a bank loan.

Retail stores, having overstocking in warehouses and shelves, in order to increase turnover and increase their sales, simply released goods and services on trust in installments, making notes in thick granary books, and in case of late payment of regular payments, they levied fines from their customers. In those years, there were no single customer assessment databases, no sales and payment automation systems.

With the passage of time and the emergence of new payment instruments such as cards and POS terminals, credit bureaus and customer evaluation companies, business process automation has emerged, thanks to which retail chains have been able to efficiently and with minimal risk increase turnover and profitability of sales, while reducing commissions, thanks to direct lending to its customers for installment sales.

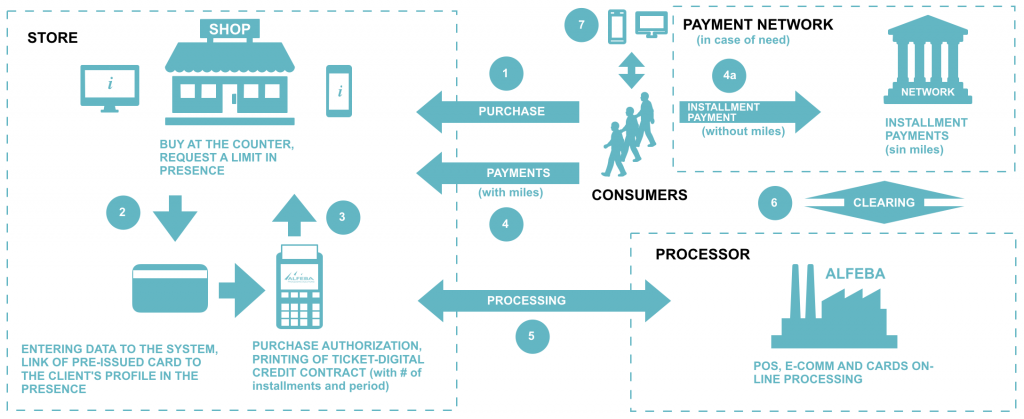

BUSINESS SCHEME OF THE PRODUCT

The business model of the product for a store or self-employed person is not competitive with the bank. On the contrary, owning modern and globally proven automated technology for direct sale of goods in installments, each bank servicing the store gains its advantage over its competitors by focusing on corporate services and moving away from the routine of retail banking business, which is undoubtedly associated with risks.

In this case, the bank provides its client – a shop or a private entrepreneur – with proven and modern technology, stable settlement and cash services and, if necessary, lending against working capital.

So that we developed the payment scheme for this product independently from the bank participation.

SCHEME BUSINESS PROCESS DESCRIPTION

- The buyer purchases a product or service in a store and asks the seller to complete his purchase in installments in his presence.

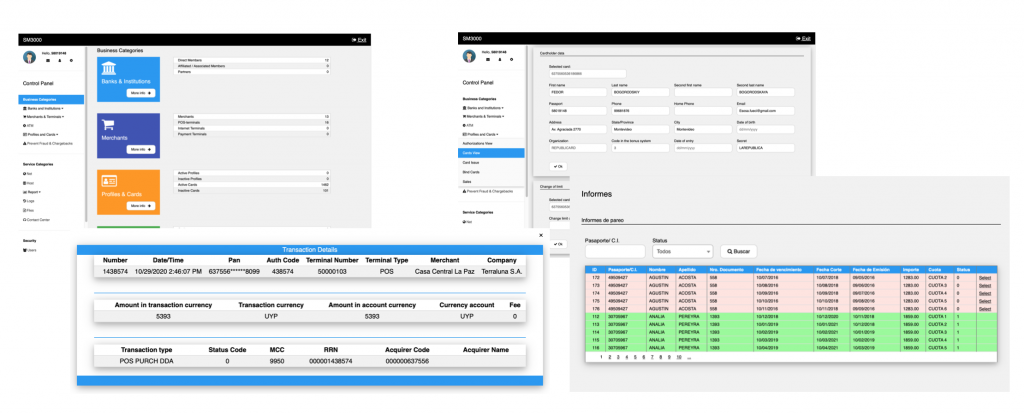

- The seller behind the counter takes a previously issued loyalty number card from him, finds it in the SM 3000 PAYMENTS system through the web-access interface, enters data about a new customer, forming his profile, and sets a limit according to the purchase amount or in accordance with the store’s policy. In case of checking a client in Equifax or another system, he performs the necessary actions based on the client’s passport number. Depends on the store preferences, checking the client in the database of credit histories can be automated and carried out without the participation of the seller in real time mode at the time of the purchase request (card authorization) through the POS terminal, through the seller’s interface or e-commerce.

- The seller accepts the previously issued card for payment to the buyer, and reads it in the POS-terminal installed on the counter and connected to the SM 3000 system (in the case of use of e-commerce mode all of the steps are automatized). On the check of the POS-terminal, a loan agreement is printed, which is signed by the client. At the time of payment with the card issued to the buyer, the seller enters a) the purchase amount, b) the client’s passport number, c) the number of installment payments and d) the store’s invoice number. At the time of purchase, the buyer receives bonuses in the amount and according to the loyalty scheme/ algorithm previously established by the store.

- The buyer pays the installment payments according to the schedule approved by the store and viewed in the client’s personal account, in the store itself through the installed POS terminal (or at the store’s web-page) with the accumulation of bonuses, or in the payment acceptance network.

- Processing authorizes the request for the card and the POS terminal (e-commerce internet-store).

- Processing clear with payment acceptance networks.

- The buyer views the history of purchases and upcoming loan payments via the Internet on his mobile phone or on a computer via the web interface, manages the accumulation of bonuses or the payment for an upcoming purchase, requests an increase in the credit limit or card expiration, and also blocks his card in the case of loss or stolen.

BUYER/ CARDHOLDER INTERFACE

The buyer is given the opportunity to register in the system to have direct access to data on completed transactions and upcoming payments, the ability to manage the bonus program, block the card or request an additional limit for purchases in installments. The buyer can also pay for the upcoming payment using the card of payment systems operating in the region.

The interface for the buyer is presented in a convenient form for a mobile phone or for a computer through a browser, which saves space on a mobile phone and minimizes the risk of data theft by intruders. If there is a second card, for example a gift card, it and operations on it will automatically be included in the menu of the client’s existing personal account.

STORE INTERFACE

To work with sales by installments, the store is provided with a convenient and easy-to-use interface via a mobile phone or computer.

A store can delegate access rights to menus and functions to its employees, depending on its internal work policy.

Access to the system in real time allows you to create new customers and edit data on them, new branches, cash desks and card acceptance terminals, set credit limits, view information on sales and perform other actions in the system as needed.

To work in the SM 3000 system, we have developed Instructions for users explaining each step of performing the required operation with a visual image of the interface and a dictionary of terms and definitions.

POS-TERMINAL INTERFACE

The POS terminal installed by the seller in the store allows the following actions with magnetic and chip cards, as well as with cards and NFC devices:

- sale by installments,

- balance view,

- sale without installments,

- replenishment of the card (change of the card limit),

- payment of payments in installments,

- cancellation of the sale,

- return,

- reports and closing of the day.

The terminal monitor displays the logo and store data. For the further information on the available POS-terminals, please, go here.

RELATED PRODUCTS

As part of the Hire Purchase program, additional tools such as bonuses and a gift card can be activated for the store. A buyer’s card can be added to an existing online store as an additional payment tool. At the same time, for a store that does not yet have online sales, its own online store can be developed with the acceptance of the card in installments, as well as cards of payment systems present on the market, and direct debit of the bank account (payment from the bank account).

REMOTE SALES OR MO/TO

Many stores are looking to optimize costs by implementing telephone sales. Such a sales function is transferred to a call center, in-house or by contract.

We have developed a special SM3000 PAYMENTS system for remote sales in the international MO / TO format with a special interface for operators.

The telephone sale process minimizes the operator’s actions and eliminates the work with cards, concentrating on establishing a new customer and registering a sale with automatic binding of a pre-issued active card number, on the basis of which a customer profile is created, which can be issued in physical form later, already with a first and last name. and transferred to the buyer.

The remote sale process is accompanied by the authentication of the sale by the method of simplified customer identification, carried out by sending a one-time code in an SMS message to the buyer’s mobile phone, which he notifies to the call center operator, for further entering into the system and confirming the sale. In the same message, the Buyer is sent his loyal customer card number and a link to enter his personal account.

During the conversation between the operator and the customer, the operator is presented with tips in the form of the text of the installment agreement, which is read out by the operator and signed by the client in the form of a one-time code communicated by him to the operator, received in an SMS message, and service messages read by the operator to the client.

PRODUCT DEVELOPMENT AND INTERACTION WITH OTHER SYSTEMS

To increase the client’s access to the hire-purchase services, the store can be installed a Self-Service Terminal and developed an individual interface script for it.

The hire purchase system can be integrated with the credit blockchain, accounting, banking and credit checking systems in real time.