ABOUT

Any football, baseball or basketball club, university or students’ camp etc. has its own members, which support the club or the other entity and pay monthly or annual payments, access the physical and logical facilities, pay with internal Coffee shops and stores. To support the mentioned functionality and to control the members and its payments we developed the special product – membership card.

WHITE LABEL GIFT CARDS

The easiest and cheapest way to start giving a membership card to your member is to create your own card design and print the card physically or virtually, accompanied with a POS or e-commerce acceptance terminal. You can start doing it in a couple of days without any licenses or investments. This card will be accepted by yourself in your own stores or other points of interest and processed using our processing facilities, by our outsourcing services or buying our SM3000 processing platform.

Your member will get a modern product with a web-based access to it account/ card profile with a transactions history and other functions.

CO-BRANDED CARDS

The best product that you can offer to your member is a MasterCard/ VISA o other payment system based card, which can be accepted not in your infrastructure only, but in the whole payment system network around the world.

To start doing this card you must have your own payment system license or the bank/ company partner, which provides you the payment system license for the card issuing with you own design. This card will be the banking one and will be issued under the Co-brand issuing program.

MEMBERSHIP CARD PRODUCTS

Membership card can include a number of products to support your organization requirements:

- physical and logical access control;

- internal payment;

- bills and membership annuals payment;

- loyalty;

- gift;

- internal credits for members.

Using NFC devices for your membership card, as well as rings, bracelets or NFC cards, you can present this card at the moment to your member directly.

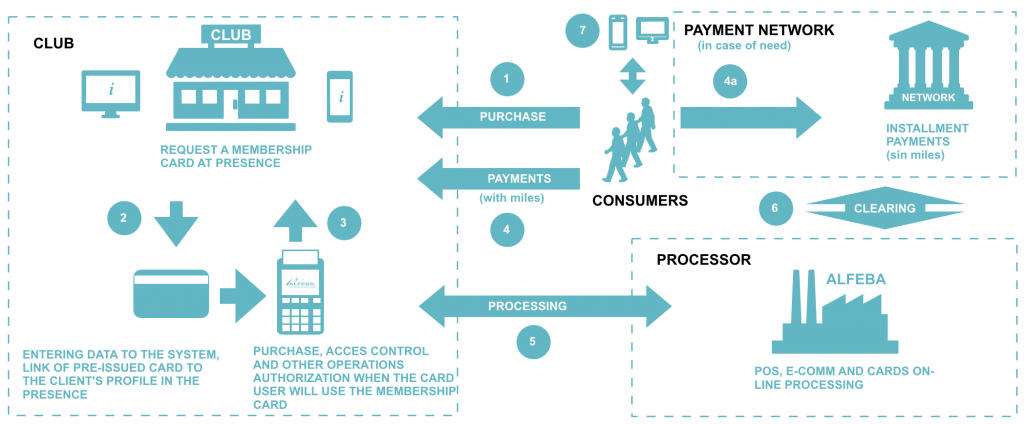

BUSINESS SCHEME OF THE PRODUCT

The membership card is not a banking card, can be presented to the customer in the point of the entity directly without a bank participance. The easiest scheme can be presented was below.

SCHEME BUSINESS PROCESS DESCRIPTION

- The MEMBER gets a membership card in the entity point.

- The club employer behind the counter takes a previously issued membership card or NFC device, finds it in the SM 3000 PAYMENTS system through the web-access interface, enters data about a new member, forming his profile, and sets a products and limits for these products, for example according to the amount of the annual payment etc. In the case of the loyalty product, he adds a loyalty scheme to this card.

- When the customer presents the membership card to access or pay, the operator accepts the previously issued card or NFC device for payment or for the access, and reads it in the POS-terminal or NFC card reader installed on the counter and connected to the SM 3000 system (in the case of use of e-commerce mode all of the steps are automatized). At the time of the operation, the Member can receive bonuses in the amount or points and according to the loyalty scheme/ algorithm previously established by the Entity.

- Processing authorizes the request for the card and the POS terminal (e-commerce internet-store).

- Processing clear with payment acceptance networks if the card in a co-branded one.

- The Member views the history of purchases via the Internet on his mobile phone or on a computer via the web interface, manages the accumulation of bonuses, manage other operations and also blocks his card in the case of loss or stolen.

MEMBER INTERFACE

The Member is given the opportunity to register in the system to have direct access to data on completed transactions, the ability to manage the Membership programs or to block the card.

The interface for the buyer is presented in a convenient form for a mobile phone or for a computer through a browser, which saves space on a mobile phone and minimizes the risk of data theft by intruders. If there is a second card, for example an internal membership credit, it and operations on it will automatically be included in the menu of the member’s existing personal account.

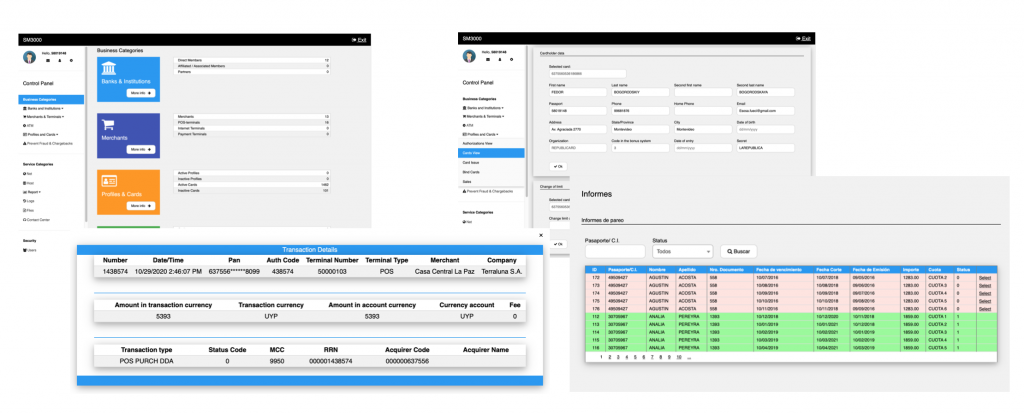

MEMBER ENTITY INTERFACE

To work with membership cards, the Member entity is provided with a convenient and easy-to-use interface via a mobile phone or computer.

A store can delegate access rights to menus and functions to its employees, depending on its internal work policy.

Access to the system in real time allows you to create new member profiles and edit data on them, new branches, cash desks and card acceptance terminals, internal club’s shops etc, set credit limits, view information on sales and perform other actions in the system as needed.

To work in the SM 3000 system, we have developed Instructions for users explaining each step of performing the required operation with a visual image of the interface and a dictionary of terms and definitions.

POS-TERMINAL INTERFACE

The POS terminal installed by the Member entity operator allows the following actions with magnetic and chip cards, as well as with cards and NFC devices:

- access control,

- credit sale,

- debit sale,

- balance view,

- replenishment of the card (change of the card limit),

- cancellation of the sale,

- return,

- reports and closing of the day.

The terminal monitor displays the logo and store data. For the further information on the available POS-terminals, please, go here.